[ad_1]

[ad_1]

- Uniswap agriculture will end on November 17, releasing all funds locked inside.

- About $ 1.1 billion in ETH will be released “in the wild,” potentially leading to a spike in trade influx.

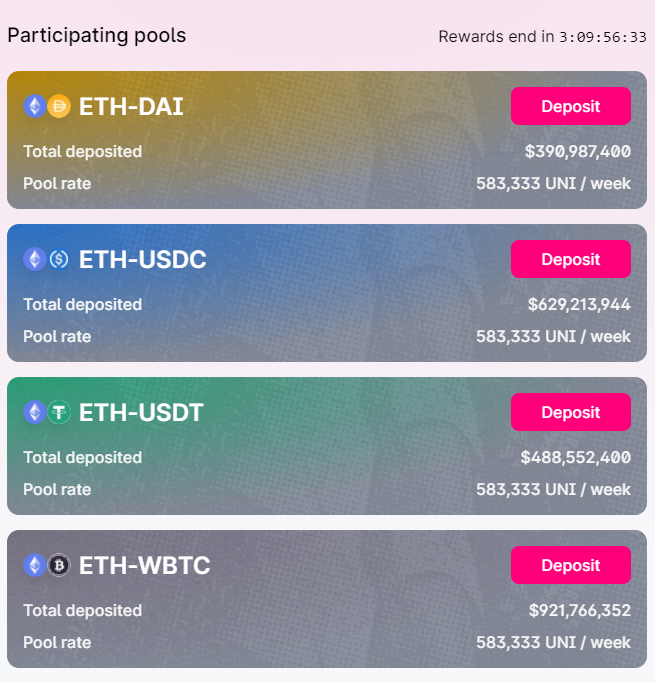

Uniswap conducted the first community call to discuss upcoming actions after the end of UNI agriculture on November 17th. The largest decentralized exchange had four ETH-based liquidity pools running since September 17, rewarding users with 583,333 UNI per week, per pool. However, as no decision has been made and there are no proposals to extend or launch new pools, these funds worth approximately $ 1.1 billion in ETH could be released to the market, potentially increasing supply and lowering the Ethereum price.

Investors are now worried about UNI and Ethereum prices. For example, UNI holders might start downloading their drawn UNI when incentives run out. Likewise, $ 1.1 billion in ETH could be sold or reinvested in something else.

The main idea behind the shutdown of the UNI farming pools is to help Uniswap in the long-term price. More than $ 2.3 billion in digital assets have been locked into UNI pools ranging from DAI, USDC, USDT, WBTC and ETH.

Can the price of Ethereum survive the potential increase in selling pressure?

It is important to note that although pools will no longer reward users with UNI tokens, liquidity providers will continue to profit from fees. This indicates that some of the Ethereum stuck inside will remain there.

These pools had been open since September and the price of Ethereum has risen by 50% over this time period. It seems likely that many investors will sell their ETH coins, although there are other possibilities as well. For example, they could put them somewhere else, especially now that so many new DeFi yield farming pools are being created. It is also possible that they simply hold.

However, there is also another factor to keep in mind. Investors could have withdrawn their ETH coins at any time as the pools did not have a lockout period. This adds support to the idea that most investors will continue to hold Ethereum somewhere else.

The price of Ethereum is currently $ 470 and took a notable breakout on November 11 from a triangle formed on the 4-hour chart. The digital asset retested the pattern’s upper trendline three times, successfully defending it.

ETH / USD 4-hour chart

Using the height of the pattern, the next price target remains at $ 488, which is the 2020 high set on September 1. Despite the potential increase in selling pressure, it’s also worth noting that cryptocurrency market sentiment remains positive.

-637408734241626740.png)

ETH IOMAP chart

On the other hand, if it turns out that many Ethereum coins end up in exchanges and the selling pressure increases, the Ethereum price could drop as low as $ 429, which is the most significant support according to the In / Out of the Money Around. Price (IOMAP).

.[ad_2]Source link