[ad_1]

[ad_1]

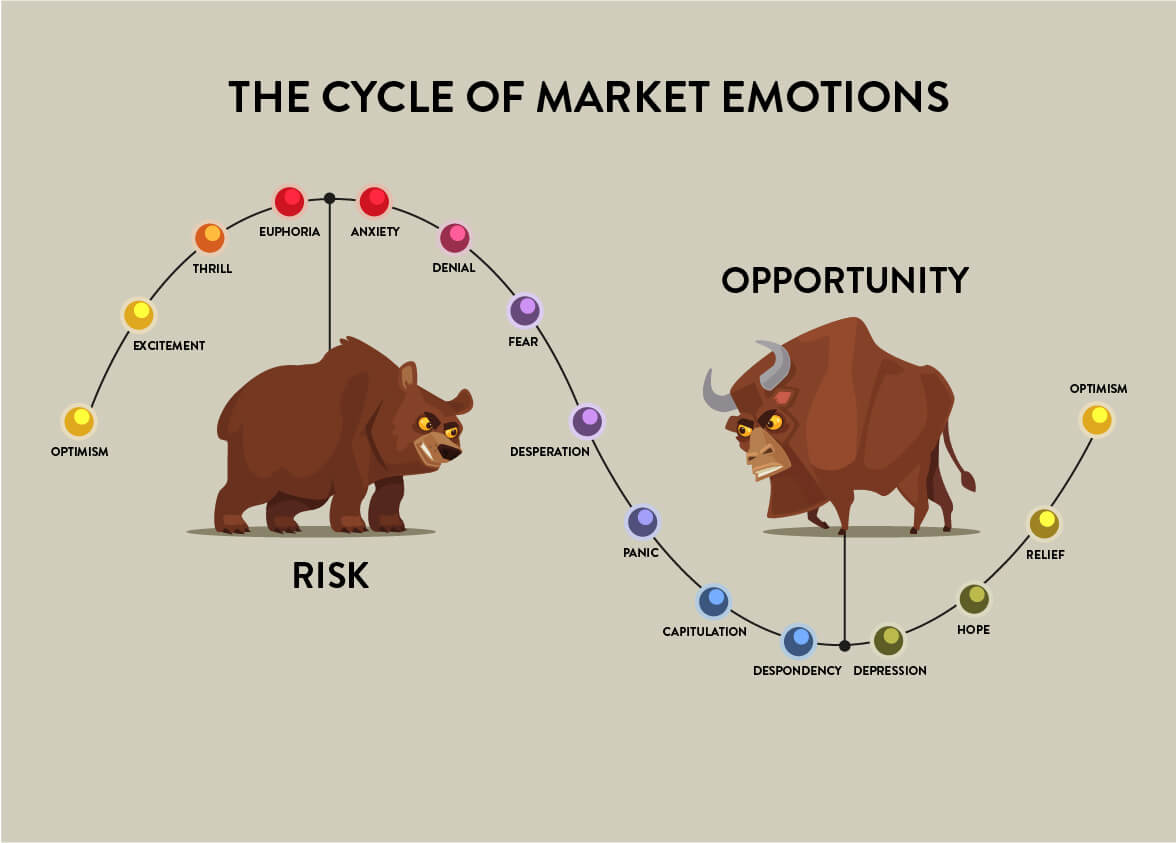

I saw the word "capitulation" mentioned a lot in relation to cryptocurrencies towards the end of 2018. There is an old (and very well known) table that describes the emotional cycles that investors have in relation to their investments.

Can this be applied to the cryptocurrency market cycle and to the investor cryptic sentiment?

The 14 stages of investor sentiment

1. Optimism

This represents the beginning of the cycle when the investor makes his first investment. After doing their research and entering the market, the investor has the positive feeling of having made a good choice and their investment will grow.

2. Excitement

If there is an initial upward movement in value for investment, then optimism is quickly joined by a bit of excitement. The investor thinks about investing more, repeating success and making even bigger gains.

3. Emotion

Thrill will quickly come into play if the first successes (or market growth) push the value of investments higher. The investor congratulates himself on his decisions, their correct choices and their experience in getting involved in the market. It's easy, so look for more opportunities.

4. Euphoria

Easy profits continue and, suddenly, Gordon Gekko * is the investor. Profits continue to grow and the investor can not go wrong. There is literally nothing that the investor can not do and tell all their friends and family about their success.

5. Anxiety

Suddenly, the market does something it should not do and moves down. Now the investor is faced with the prospect of losing part of his investment. But it's the first days. The investor can rationalize their decisions and reassure themselves that they are still profitable and that their investment strategy is sound.

This is the moment when financial risk comes into play, and it is this initial phase of anxiety that can lead investors to sell. If they sell enough investors, this can turn into a bear market. A bear market is generally characterized when prices fall mainly due to doubt and fear of investors.

6. Negation

If the markets continue to fall with few signs of rebound, then the denial begins. Here the investor continues to believe that things will improve and he will be reassured that their strategy is still correct and the market will rise again.

7. Fear

Suddenly it seems that the market will never come back. This has an important effect on investor confidence.

8. Desperation

The investor is looking for tactics or ideas that could help improve their situation. The options will be explored to exit the market to recover sufficient funds to limit any losses.

9. Panic

All hope in the market that improves or corrects is lost.

10. Capitulation

The investor is no longer interested in making a profit. It is all the limitation of damage from this point on. All that the investor can think of doing is going out of the market and recovering some of their money.

This is the true territory of the bear market now, and investors who sell off investments lead to even larger drops in a viscous circulation.

We have seen this phase of capitulation in the encrypted market in the fourth quarter of 2018.

11. Discouragement

This is an emotional low point. The investor goes away with everything he could save from his initial investment and renounces things that are changing.

For our investors, this is a low point, but for some in the market who believe in market cycles, this point can also represent an opportunity and the possible start of an upward trend. An upward trend is when prices rise in an investment market.

12. Depression

Discomfort gives way to depression, and the investor relives their failures and analyzes where they went wrong.

13. Hope

What is life without hope? And investments would not exist if markets did not improve as a result of a downward move or depression. The investor now begins to realize that the markets are cyclical. While the old warning about financial services signals to investors: "the value of investments can increase or decrease". As the market improves, the investor thinks he is involved again and starts investigating opportunities.

14. Relief

Investment sentiment is becoming positive and it is time to return to the market. Investors' confidence in their decisions is renewed and when their last investment turns into profit, the cycle resumes.

The cryptocurrency market cycle: the $ 64 million demand

Thus, this cycle is typical of many markets, and is not different in crypto. The trick is knowing (or being able to guess) where the market actually is on this cycle.

In fact, there is no easy chart that looks like what we use to illustrate our article, but there are tools available to help investors try to identify trends and understand market cycles.

If you enjoyed our article on the cryptocurrency market cycle, you might be interested in our range of cryptocurrency guides on our site, along with the latest cryptocurrency news.

* an imaginary character from the 1987 film Wall Street. The character has become synonymous with obvious and enthusiastic financial greed.