[ad_1]

[ad_1]

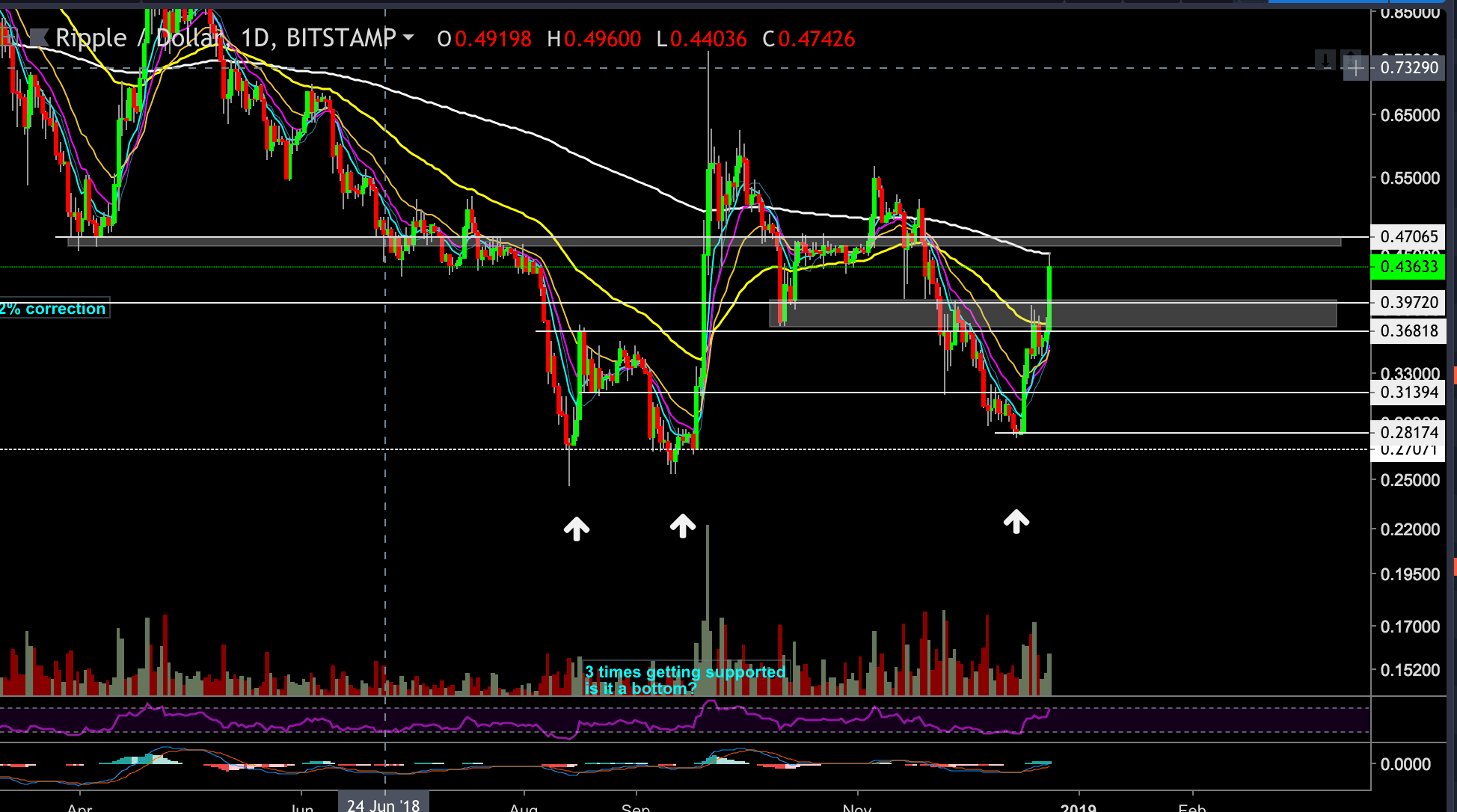

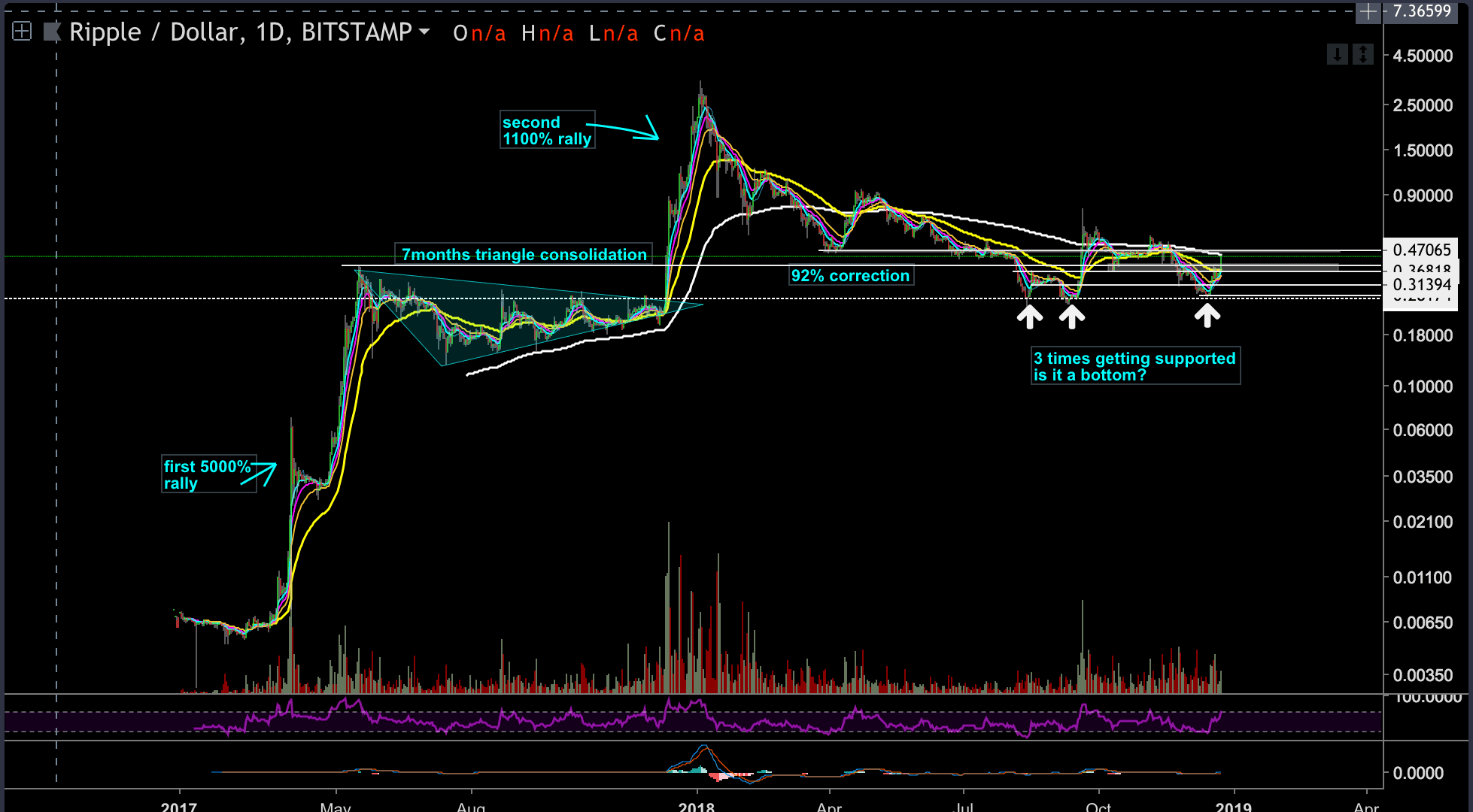

Before delving into the current status and XRP analysis, we begin with a broader review (see the following XRP-USD daily chart):

XRP had two major rallies in its brief history: the first XRP rally started in March 2017 and lasted for two months. This move had given XRP investors more than 5000%, an incredible return. Every $ 1000 that was invested would turn into $ 50,000. The price of XRP rose from $ 0.006 to $ 0.37.

From that time until December 2017, the XRP has consolidated itself in what seems to be an almost perfectly triangular training. It took about seven months for the triangle to develop: from the beginning of the training to the top.

The breaking of the triangle had triggered the second XRP rally, from $ 0.27 to the historical maximum to $ 3.3. Yield of 1100%.

From the peak reached in January 2018, XRP lost 92% of its value in a five-wave decline that required 11 months.

What is interesting is the fact that XRP corrected exactly the $ 0.27 level, which was the activation price of the last triangular formation that started the recent XRP rally. Well, this is not a coincidence. These are the technical rules of the markets or the way in which the "market makers" play the game.

The XRP had hit the price of $ 0.27 three times from August 2018, in what appears to be a solid floor.

It is fascinating to note that even after a loss of 92%, XRP is still trading above the price level of the first rally and the 5000% move.

So, what will happen on Ripple XRP?

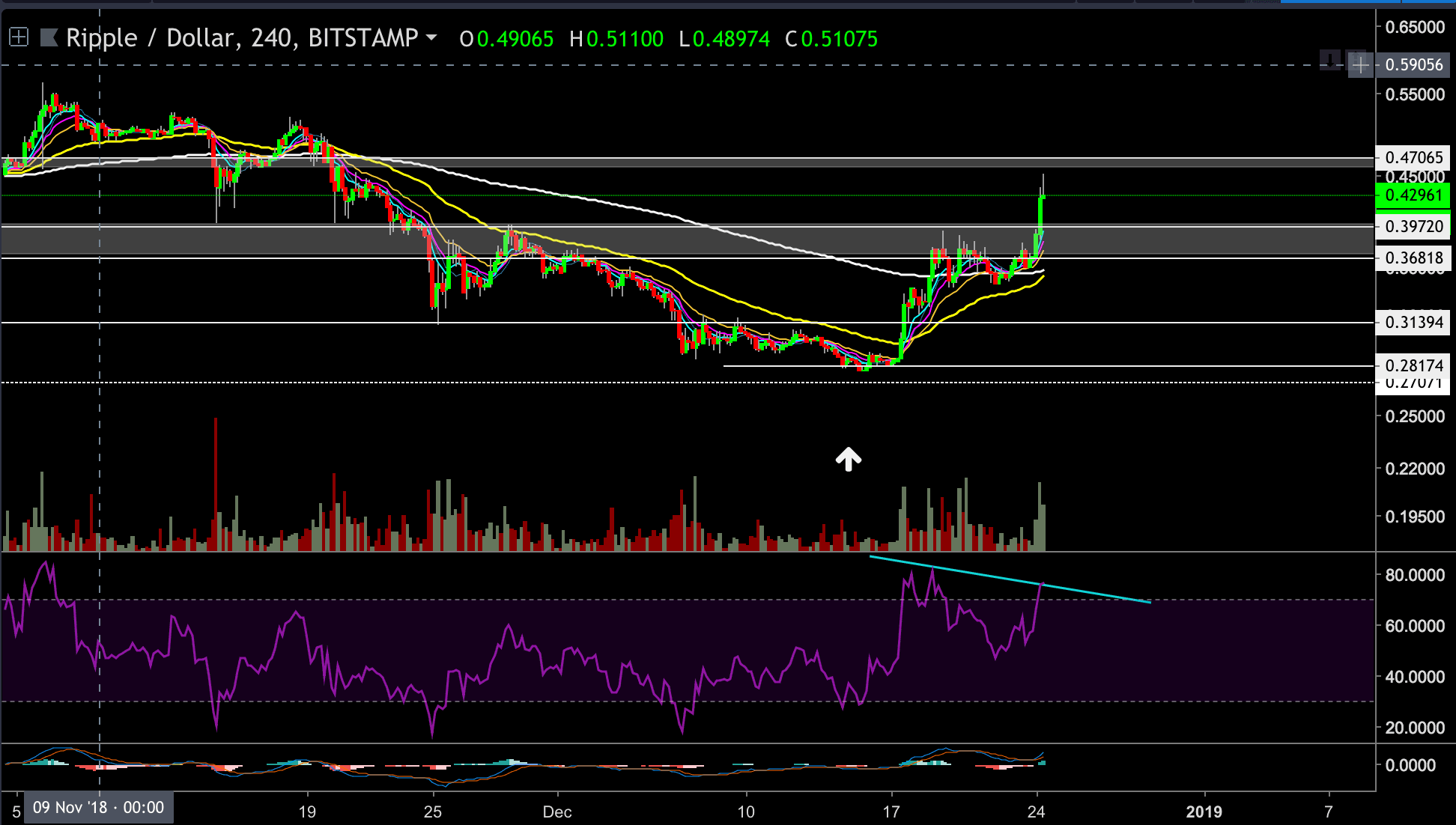

- XRP is currently trading 55% above the support level mentioned, and from a closer look (4-hour chart) we can see that for the third time the support level of $ 0.27 was maintained.

- Another thing worth mentioning is that the XRP chart did not create a higher maximum, however, from the third time it touched the support level of $ 0.27.

- In the last 12 hours, XRP has exceeded the level of $ 0.37 – $ 0.395, which is the level of resistance created by the top of the first XRP rally on May 18, 2017. The next target for XRP could be found around the resistance level $ 0.45 – $ 0.47.

- However, we can assume that it would not be easy for XRP to break the resistance level of $ 0.47 on the first try. As of now, XRP is facing the resistance of the 200 EMA on the daily chart.

- The XRP could consolidate sideways in order to gain momentum for a second breakout attempt, or it could test the $ 0.395 resistance support again.

In a more bearish scenario, lower support is on the medium channel support level at $ 0.3139. If XRP breaks below that level, XRP will probably try to test the $ 0.27 support level again, but it's too early to determine it. - Looking at the 4 hour chart: After a nice bullish move, XRP is in the intermediate channel between the resistance from $ 0.45 to $ 0.47 and the support level from $ 0.395 to $ 0.37. A breakout on any side will determine the short term of XRP.

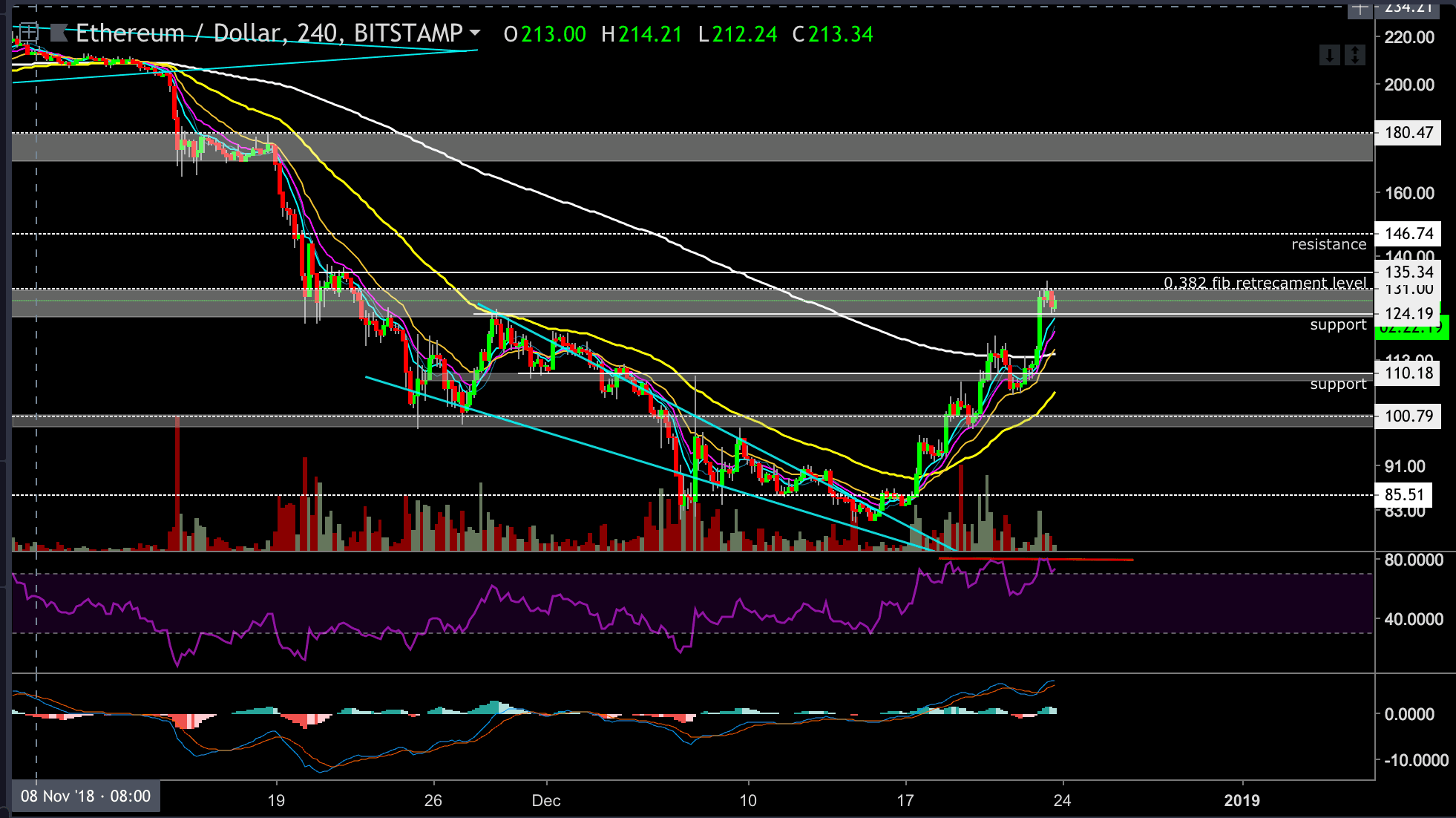

- The 4-hour RSI hovers around the overbought zone with negative deviation signals starting to develop (higher highs on price while lower highs on RSI).

BitStamp XRP / USD 4-hour chart

BitStamp XRP / USD 1-day chart

Diagram 1-day XRP / BTC BitStamp

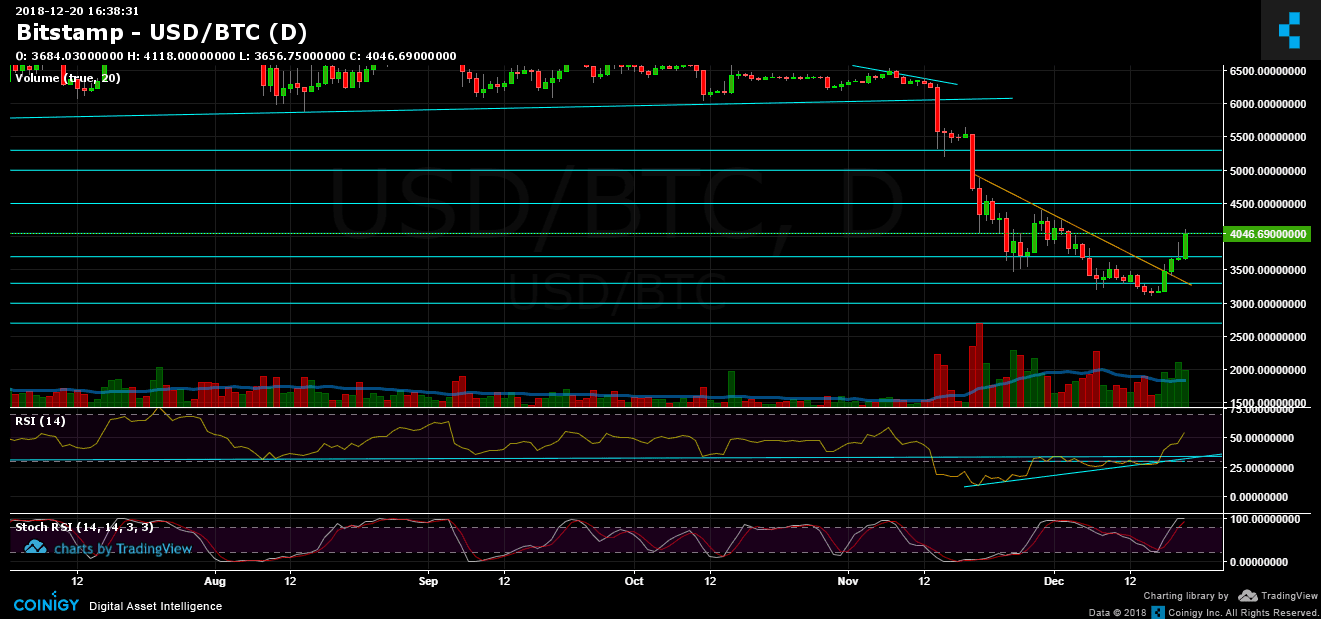

Looking at the 1 day XRP-BTC chart, we can see that XRP is approaching the resistance zone BTC 0.0001-0.000115 for the fourth time.

He recently passed the resistance level on September 19, and immediately withdrew. Since then, XRP has tried several times to approach the significant resistance level, while creating higher lows.

This is the most critical price level against Bitcoin at the moment, taking into account that from the bear side, the nearest significant support level is at the 0.0000855 BTC level, before the 0.000067 plan.

CryptoPotato video channel

More news for you:

[ad_2]Source link