[ad_1]

[ad_1]

The popular digital currency, which is arguably one of the most polarizing in the financial markets, is approaching unprecedented levels since the frenzied cryptocurrency rush three years ago.

Bitcoin BTCUSD price,

Wednesday briefly reached an intraday peak at 18,358.98, and was retreating in recent trading but was still on pace for the fourth-highest result in its history since December 2017, when the asset briefly flirted with $ 20,000 before plummeting dazzlingly, according to Dow Jones Market Data, based on an eastern close of 7pm.

But now bitcoin is attracting eyes and wallets again, outperforming gold prices

and the stock market, with a year-to-date lead that has exceeded 150% so far in 2020.

So why does the asset, based on distributed ledger technology, suddenly seem poised to surpass its 2017 peak at $ 19,783?

There are a few key reasons:

Scarcity factor

Bitcoin was created in 2009 and as part of its creation by one or more people, using the name Satoshi Nakamoto, who incorporated a limit of 21 million coins into the original bitcoin code. This means that only 21 million bitcoins will ever exist. Currently there are 18.5 million in circulation, or almost 90% of the total.

Bitcoins are mined digitally by those who spend huge sums of computer power to solve puzzles and who are rewarded with coins in exchange for verifying transactions on the anonymous blockchain network.

Nakamoto has designed the coins to be more difficult to obtain as the net approaches maximum float. It is estimated that it will take 120 years to “mine” the remaining 10% of bitcoin needed to reach the limit of 21 million.

The perceived scarcity, or supply limit, of an asset does not magically add value to it. But the belief that there will be fewer opportunities to get bitcoin, or that it will reside in the hands of a select few, is often cited as one of the reasons why demand for bitcoin has returned.

The familiar breeds … buy?

Bitcoin does not have the cachet or tradition of other assets that have been around for much longer, including gold, which boasts a history dating back thousands of years as a store of value and medium of exchange.

However, bitcoin’s popularity has grown among both average people and institutional investors, proponents say.

Bitcoin as a so-called unrelated asset, not directly linked to price swings, for example, in gold, bonds or the Dow Jones Industrial Average DJIA,

o S&P 500 SPX index,

led to some bitcoin purchases as financial backing.

“Derivatives have played an important role in these markets, helping the variety of products available to active traders to improve their understanding of market dynamics and underlying risk management,” Catherine Coley, CEO, told MarketWatch. by Binance US, one of the largest cryptocurrency exchanges in the world in an email exchange.

The rise of stablecoins

Another factor related to familiarity is the emergence of stablecoins, i.e. those cryptocurrencies that are usually pegged to a fiat currency, such as the DXY dollar,

or the euro EURUSD,

These coins have nearly no volatility associated with a generic cryptocurrency due to their hooking to a traditional currency that often backs it.

Stablecoins have become a major source of liquidity in cryptocurrency markets, experts say.

Such government-backed or corporate-backed coins have also lent the digital currency industry an air of legitimacy, with the Federal Reserve exploring the possibility of issuing its own digital currency, amid reports that China is moving forward with one yuan. digital. According to reports, the world’s second largest economy launched a trial of a digital currency last month.

The UK is also pushing the idea of a stablecoin for its central bank, according to a statement by Chancellor of the Exchequer Rishi Sunak.

Leading institutions include JPMorgan Chase & Co. JPM,

launched an interbank payment system using its own blockchain-based technologies to create a dollar-pegged digital asset called the JPM coin.

Fall of the dollar and golden rivalry

Concern that governments are printing a lot of money on paper over the problems created in part by the 2008 financial crisis was at least part of the reason that bitcoins were created over a decade ago. That thought is also the basis for this bitcoin renaissance, crypto experts have said, as the COVID-19 pandemic forces governments and central banks to spend to limit the economic blow.

The dollar has fallen 4.2% so far in 2020, as measured by the ICE US Dollar Index DXY,

a dollar measure against half a dozen currencies, including the euro. This puts the dollar in step with the worst annual decline since 2017, when bitcoin was on the rise.

“Bitcoin as a form of digital gold is also seeing its time in the sun as we see the doors open on monetary policy. Closing the shutter is more difficult than opening it, “Charles Hayter, founder and CEO of CryptoCompare, a company engaged in bitcoin data and analysis, told MarketWatch.

Anthony Denier, CEO of Webull, a crypto-trading platform, said the low interest rates also reduced the cost of owning bitcoin compared to dollars or bonds.

In an email exchange, Denier said “you have an extremely low interest rate environment that makes fiat stocks obsolete.”

Mainstream appeal … and more

PayPal PYPL,

recently said that users on its platform will be able to buy bitcoin, as well as other sister cryptocurrencies like Ethereum, Bitcoin Cash, and Litecoin. PayPal’s decision last month was a further recognition of the legitimacy of digital currencies, crypto enthusiasts say.

“Bitcoin today has gotten to a point where institutional investors, banks and family offices are legitimately pondering involvement as a defense against currency devaluation,” Celsius Network CEO Alex Mashinsky wrote in an emailed comment.

“This is no longer a gold rush, it is a good investment,” he said. He predicts bitcoin will hit $ 30,000 by the end of next year.

To read: Bitcoin’s bull sees the digital currency at $ 55,000 or $ 60,000 by the end of 2021

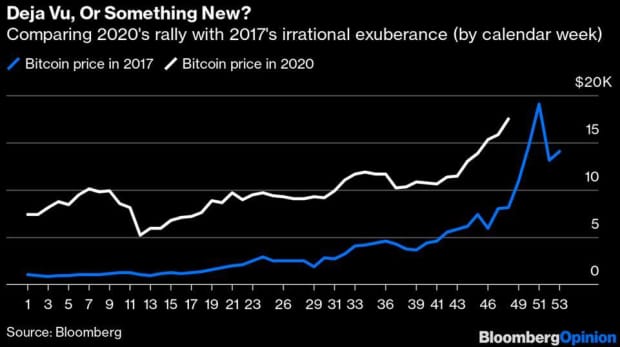

2017 vs 2020?

Some bulls argue that this rally in bitcoin is different from that of three years ago which resulted in a massive and painful upward head falsification and a lower slump for enthusiasts.

As the chart below shows, the price of bitcoin is significantly higher than it was three years ago right now, wrote Matthew Weller, head of market research at GAIN Capital in a research note.

Bloomberg, GAIN Capital via Matthew Weller

Weller has suggested that this time around there is less hype about the move for bitcoin and, therefore, it may be more sustainable even if there will be a withdrawal in the coming weeks.

“Bitcoin is clearly overbought in most short to medium term time frames, so a short pullback / consolidation is likely soon, but the world’s oldest cryptocurrency closed exactly three days above its current price close to $ 18,000, so there is little amidst general resistance to prevent new all-time highs this year, ”he wrote.

A word of caution

It is important to note that not everyone is a fan or a believer in the inevitability of bitcoin as a legitimate asset in the financial markets. Critics say bitcoin is best used in money laundering and other criminal activities and makes distinctions between digital currencies and the blockchain technology that supports them.

Jamie Dimon, CEO of JPMorgan Chase, said bitcoin was not his “cup of tea” at the New York Times DealBook Summit on Wednesday, although he extolled the virtues of blockchain-backed JPM currency.

Dimon and others believe governments can impose regulations on digital currencies that could nullify their appeal.

To read: Dalio says “something may be missing on bitcoin” – challenges Twitter to change his mind

.[ad_2]Source link