[ad_1]

By Geoffrey Smith

Investing.com – Joe Biden takes advantage in Georgia as control reaches its final stages there and other heavily contested states. It rises again as the dollar falls, but the shares take a break. Nonfarm employment data is expected to point to much slower growth in October, as Covid-19 cases in the United States hit new all-time highs and deaths peaked in the past four months. Here are the top five numbers to watch this Friday November 6th in the financial markets.

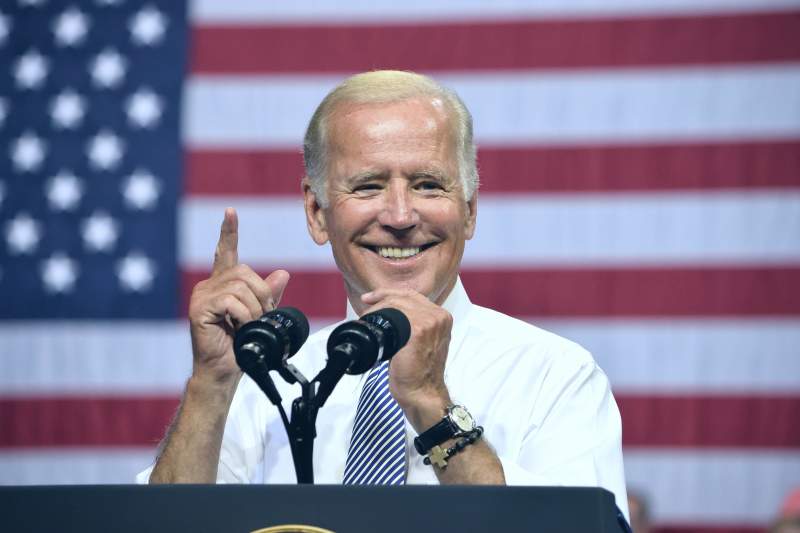

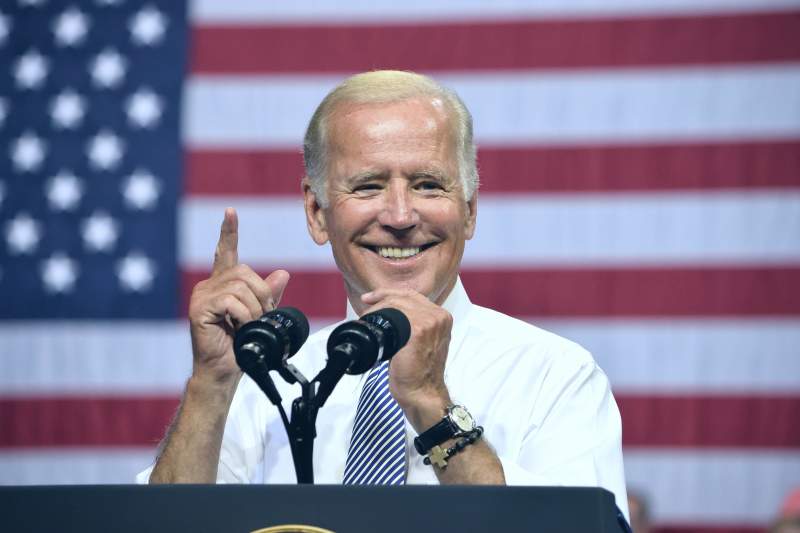

1. Biden gains command in Georgia; Trump continues to put obstacles

Joe Biden has come even closer to victory in the presidential election, winning by a narrow lead in the state of Georgia as the vote-counting process reaches its final stages.

Votes from Clayton County, which includes Atlanta’s southern suburbs and some suburban townships, supported the Democratic Party candidate in the early hours of Friday morning.

Vote counting continues in Georgia, as well as in North Carolina, Arizona and Nevada. President Donald Trump has already formally requested a recount in Wisconsin, which awarded the victory to Biden.

In his first public appearance since election night, Trump repeated the allegations of election fraud, once again without presenting evidence. Two lawsuits by Trump’s team have already been dismissed by state courts.

2. The employment report probably indicates a slowdown in hiring

The US will release its official October job market report at 2.30pm (CET), in the shadow of an ADP report earlier in the week that showed a sharp slowdown in private sector hiring.

Analysts have attributed much of that slowdown to the hotel and other service sectors affected by the growing wave of Covid-19 cases across the country. The number of new infections rose to new all-time highs of more than 121,000 on Thursday, while the death toll fell to 1,108 from a four-month high of more than 1,600 on Wednesday.

In his press conference Thursday, Federal Reserve Chairman Jerome Powell said the coronavirus continued to pose a serious threat to the economy, reaffirming the Fed’s commitment to provide more monetary support if needed.

3. Stocks down after the rally

US equity markets are aiming for a bearish opening this Friday, taking a break from the relentless rally as preliminary election results seemed to rule out a “blue wave” that could have led to large increases in both corporate tax and taxes. as well as the capital gains tax.

At 12:30 pm (CET), 30 futures were down 0.5% or 139 points, while S&P 500 futures were down 0.7% and 30 futures, which had underperformed. compared to the average of the last two days, they fell a little more, 1.0%.

Car inventories could gain interest after new vehicle sales figures declined in October for the first time since April, largely due to light truck sales.

The earnings release season continues apace, with early reports from CVS, Virtu, Hershey, Marriott and Coty, among others.

4. Gold, 7-week highs as the dollar falls

Gold prices hit seven-week highs as expectations of looser fiscal and monetary policy in the US rocked the dollar.

At 12:30 ET, gold futures were up 0.5% to $ 1,957.20 per troy ounce as the dollar index hit two-month lows at 92.263. The dollar lost more than 2% against other major currencies this week, while the losses against emerging market currencies were even greater.

This is partly due to the fact that the foreign exchange market expects US foreign policy to be less aggressive towards countries like China and Mexico. The yuan has steadily strengthened since China managed to contain the coronavirus in the spring; weight gain has been more recent and more moderate, although it also accumulates gains of 3% over the past month.

5. Oil, hit by OPEC’s fight for market share

Oil prices are falling sharply as the rebound due to post-election risk wears off and the market continues to absorb signals that OPEC members are locked in a fight for market share.

At 12:30 pm (CET), US futures were down 3.7% to $ 37.36 a barrel, while futures were down 3.2% to $ 39.60 a barrel.

On Thursday, Saudi Arabia announced further discounts from local reference prices to official December sales prices, while Iraq, OPEC’s second largest producer, said it produced above its agreed quota in October, taking advantage of the discipline of the other members.

Last week’s Baker Hughes active count data will close the following week.

[ad_2]

Source link