[ad_1]

[ad_1]

Bitmain is the most important mining company and one of the most successful companies in the crypto-ecosystem. Jihan Wu's company has contributed so much to the development of the crypt-versus that many believe that no other private company can compare it

However, despite these facts, the image of Bitmain is negative at the time. inside the ecosystem. Last year, Coindesk listed Jihan Wu as one of the ten most influential figures of the crypto-verse, describing it as "The Villain."

Bitmain recently announced its plans for an IPO, a decision that could further increase its financial value but after revealing some facts about its business scheme, the company debate quickly reignited.

Here are three interesting facts that show the dark side of Bitmain:

Here are three interesting facts that show the dark side of Bitmain:

1. "Non-ethical" mining practices

The mining company known for promoting Bitcoin Cash does so not only for the sake of the advantages of that crypt, but for the ease with which it can dominate most of the mining power.

According to Trustnodes, Bitmain is very close to owning 51% of the hashing power of BCH. Some sources put the current figure at about 49.64%

According to Trustnodes, Bitmain is very close to owning 51% of the hashing power of BCH. Some sources put the current figure at about 49.64%

Likewise, Bitmain is facing some allegations of secret extraction, a practice through which they use their own ASICs to extract the cryptography before putting them on the market . This would give Bitmain a substantial competitive advantage over other miners, as this would increase hashing power with little competition, guaranteeing significant profit. After this practice, they start selling their devices.

Bitmain denies these allegations:

"In the end, Bitmain appreciates transparency and fair competition, and we remain opposed to this practice [secret mining] and maintain our long-term zero-tolerance policy regarding the same" .

However, in the information provided on the occasion of the IPO, Bitmain omits some details about their mining activities.

However, in the information provided on the occasion of the IPO, Bitmain omits some details about their mining activities.

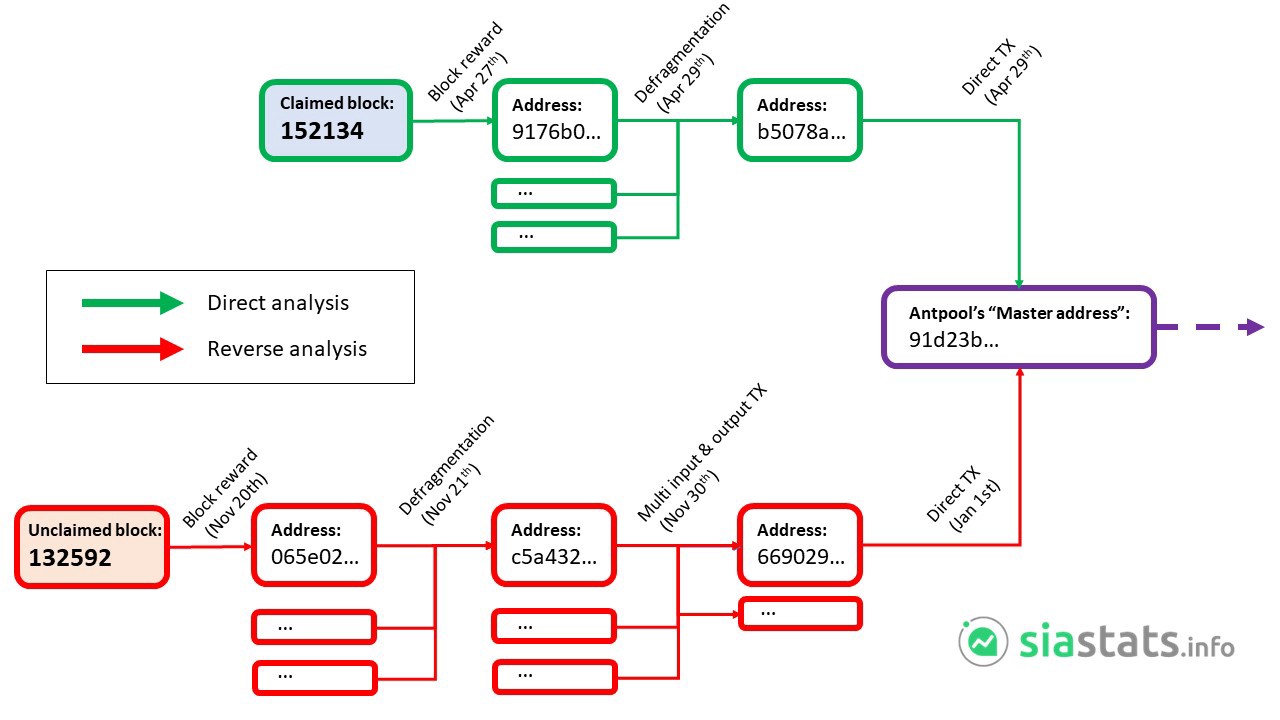

Recently, the SiaCoin development team revealed that Bitmain was secretly extracting its token before making its ASICs available on the market. Salva Herrera, creator of SiaStats explains:

"The oldest block we can trace of Antpool is # 132204, dated November 17, which means that Bitmain has extracted Siacoins in secret for exactly 2 months …

According to some estimates, the development of the A3 cost 10 million dollars.If they planned the operations carefully, this means that they could recover the full cost of the ASIC development only from secret mining during those 2 months, of course, in addition to the $ 74 million in sales profits only from the first 2 lots ($ 2300 per unit and 33,000 units as we explained above). "

2. The reasons behind their pumping strategies BCH

Bitmain promotes BCH, but this crypt has already caused at least $ 500 million of losses

A leaked prospect of the Bitmain IPO shows that Bitmain owns about 1 million BCHs ; an amount that would be difficult for them to capitalize given the small market of that mess over Bitcoin.

Bitmain holds more than 1 million BCHs and almost no Ethereum. It seems they have converted BTC to BCH. https://t.co/8UTU7N4Qrs pic.twitter.com/ORLeoji7Gm

– Bitcoin (@ Bitcoin) August 15, 2018

In fact, according to information provided by Trustnodes, l & # 39; company invested in the altcoin when the chip price was around $ 900, so Bitmain's BCH investments represented a loss of about $ 500 million.

According to the bunch of pre-IPO investors of Bitmain, they sold most of their # Bitcoin for #Bcash . At $ 900 / BCH, half a billion have bled in the last 3 months. If the Bitcoin Core developers did not reveal Bcash's vulnerability, they could have erased a billion dollars from their budgets. pic.twitter.com/9BMywdvvby

– Samson Mow (@Excellion) 11 August 2018

An increase in the adoption of this token would imply an increase in the budget of Bitmain and other large supporters of BCH.

3. The interest of large financial firms may not be as real as many think (or wish)

Some time ago, there were news about the interest of large companies to participate in the business. IPO of Bitmain. According to information published by QQ News, an important Chinese news portal, companies like Tencent, Softbank and China Gold Investment are interested in investing large sums of money in Bitmain.

Some time ago, there were news about the interest of large companies to participate in the business. IPO of Bitmain. According to information published by QQ News, an important Chinese news portal, companies like Tencent, Softbank and China Gold Investment are interested in investing large sums of money in Bitmain.

However, after a telephone contact between Cointelegraph and Kenichi Yuasa of the corporate communications office of SoftBank Group Corp, this information was revealed to be false. In the words of Mr. Kenichi:

" Neither the SoftBank Group Corp. nor the SoftBank Vision Fund were in any way involved in the agreement."

In addition, Coindesk has confirmed that a spokesperson of Tencent Inc. has commented via e-mail that the company also claims that such rumors are false

"[ Tencent Inc.] is not involved in this investment … The news is not true."

[ad_2]Source link