[ad_1]

[ad_1]

"Blockchain but not bitcoin". A phrase that seems to be late. The rapid rise of Bitcoin meant that Wall Street and large corporations stood up and took note of the losing asset class. High-flying bankers like Jamie Dimon (JP Morgan Chase) and Lloyd Blankfein (Goldman Sachs) seem to change their mind about bitcoins, blockchains and cryptocurrencies almost every other day. Climbing aboard the blockchain bandwagon might not be desirable but can no longer be ignored.

In the business world, perception is everything. As a result, companies are rushing to integrate "blockchain" into their business model, even if it is not necessary. Some stocks skyrocket with the mere mention of the word. But can private blockchains really make fun of the public cryptocurrencies? The showdown is under way and the players are ready. Let's get ready to grumble!

In the Red Corner

In May of this year (2018) former president of Goldman Sachs and former adviser to US President Donald Trump, Gary Cohn explained in a # 39; Interview with CNBC:

"I am not a big fancoin supporter, I am a believer in blockchain technology, I think we will have a global cryptocurrency at some point where the world understands it and is not based on extraction costs or on the cost of electricity or the like, it will be a more easily understandable cryptocurrency. "

The red field claims that the benefits of distributed ledger technology (DLP) can be used in a more controlled way. Several well-known companies are focusing their efforts on building blockchain solutions ready for the enterprise.

In the red corner we present Hedera Hashgraph and IBM Hyperledger Fabric:

Hedera Hashgraph

Thanks to their concentrated marketing efforts, the hashraph is receiving a lot of attention from the media. Dr. Leemon Baird conceived the Hashgraph framework in 2016 and patented it for Swirlds, a company he co-founded with Mance Harmon. Swirlds develops software for distributed private applications.

Hedera is their latest project. While Swirlds focuses on the private sector, Hedera is aiming for lucrative opportunities offered by public blockchains.

Governance

The platform is built on the basis of a closed governance model which means that up to 39 organizations from various industries and locations around the world will handle decisions on how the code is developed and on how the native cryptocurrency of the platforms is managed and distributed in the system. A sort of decentralization only for organizations, if you want.

"The Hedera Hashgraph Council will provide governance for an open, fast and fair and decentralized public register based on the hashgra consent algorithm."

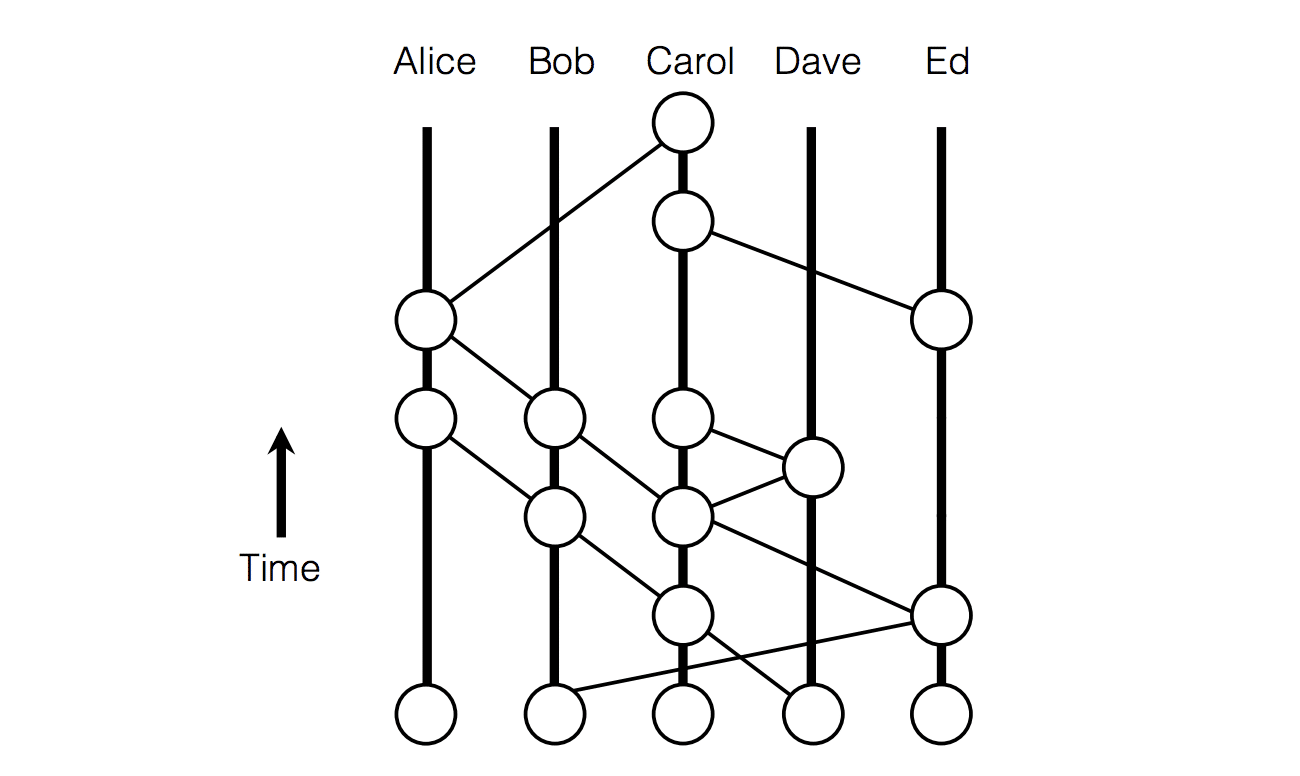

Hashgraph does not actually use your typical blockchain implementation, but actually uses something like a direct acyclic graph (DAG) that is applied in both IOTA and Nano. Use the so-called gossip .

By the Crypto Watercooler

In the gossip systems, the nodes on the network communicate with each other randomly. Because "gossip" each node will provide another node with all the information it currently has on the network, such as a transaction history. After receiving this information, this node will pass on to other nodes, and so on and so on. As a result, all nodes will reach consensus because the correct information spreads across the network.

The power of the gossip protocol in Hashgraph

Hedera will raise funds for its public blockchain token from August 16, 2018. Unfortunately, this only applies to accredited investors at this time. Their token sales are following the SAFT (Simple Agreement for Future Tokens) process, which is in line with the SEC regulations.

Hyperledger Fabric

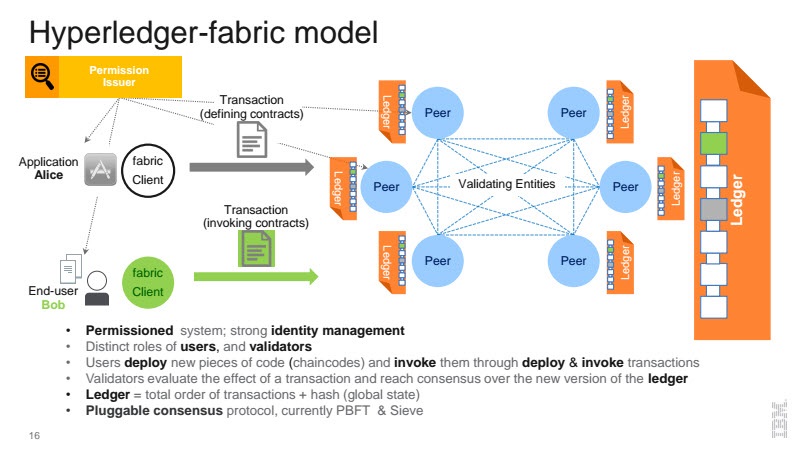

Hyperledger is an open-source blockchain technology collaboration from numerous leading companies in the financial, banking, supply chain, manufacturing and so on. Fabric was created by one of the first hackathons of this initiative and most of the code was provided by IBM that is promoting their project as "building open source blockchain for businesses".

The IBM Hyperledger approach took a slightly different view by creating plug-n-play blockchain components. Do you need a specific consent method? Just connect it. Does your company already have an identity management system in place? Just connect it. Well, this is the theory.

A blockchain of Hyperledger in action

Some key concepts of additional Fabric include:

- Private Transactions

- Confidential Contracts / Chaincode

- Data on a Need to Know

- Modular Consent

- Scalability

- Auditability and Identity

Perhaps the most important difference, however, is that Fabric has no native cryptocurrency included as part of its development and does not require one to function. Hyperledger Fabric sits firmly in the field "blockchain but not bitcoin"

In the blue corner

They are champions of the cryptocurrency revolution and defenders of decentralization. The blue field believes that peer-to-peer networks are the future. Blockchains that allow anyone to negotiate with each other without the need for a third party.

In the blue corner we present Bitcoin and Ethereum:

Bitcoin

Bitcoin was born from the financial crisis of 2008/9. Satoshi Nakamoto had enough of suspicious banking practices. Throughout history, governments and central authorities have destroyed economies through priceless debts and unlimited money press. What is worse then turned on the citizens to adapt to the bill. He / She / Have seen a way to finally change all this – Bitcoin:

1. It is a question of trust

Conventional monetary systems require us to entrust all of our trust to a third party:

- Can we trust central banks to responsibly manage our money supply in countries?

- We believe that banks give us access to our hard-earned wealth

- Will governments allow us to negotiate with anyone we like?

Unfortunately, highly reliable systems do not work in the best interests of society. For example, in the years following the European financial crisis of 2010/1, the Greek government imposed capital controls (on several occasions) by cutting large sums of money from its citizens. Imagine working all your life building wealth just to hear you say you could withdraw a maximum of € 60 ($ 69) a day.

Bitcoin changes all this. It acts a bit like money in your wallet, you own it and you can do it at your leisure. Since the global bitcoin blockchain validates your transactions, you do not need permission to access or transfer them.

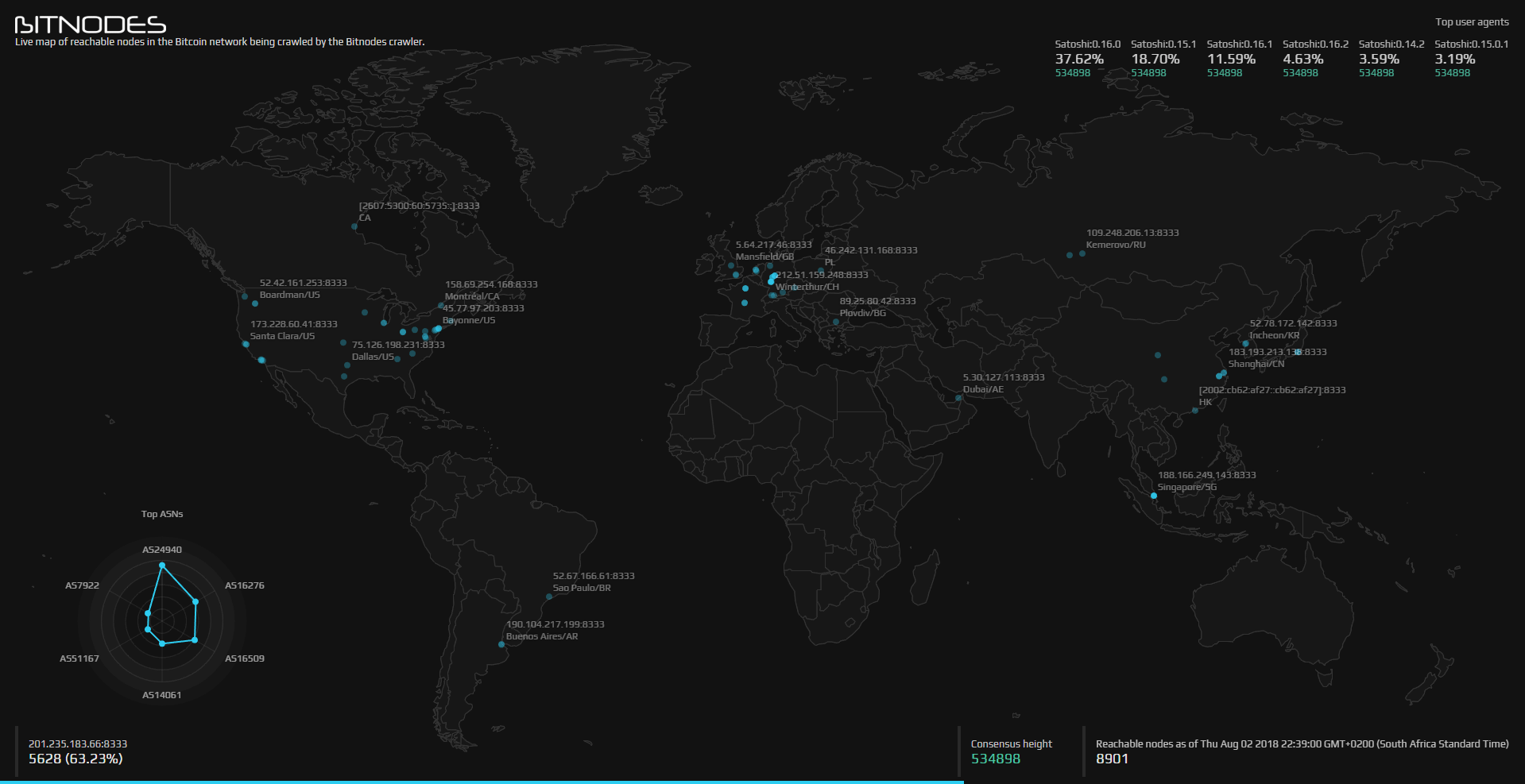

2. Solid Decentralization

The true power of the bitcoin register lies in its decentralized nature. The authority is delegated to anyone who wants to take up the challenge of validating transactions. No single authority can reverse transactions and / or change the rules if and when they feel like it. Bitcoin is the first currency to exchange values without ever bothering the older brother

Here is an interesting live view of bitcoin nodes around the world.

A live view of global bitcoin nodes

3. A knot can not dominate them all

And now we come to the flesh of what makes a cryptocurrency … well, a cryptocurrency. It takes work to validate transactions in a cryptographic network and the workers (the nodes) rightly want to be paid for it. By design, the bitcoin network rewards who provides this service. It's a win-win scenario, because players compete to protect the network and no authority can develop to govern the network.

- As bitcoin is the first pioneer of blockchain technology, it is worth keeping these additional features in mind: [19659026] Supply shortage – maintaining its value

- Open-source – anyone can control, download and create alternatives [19659027] Resistant to censorship – carry out transactions without permission

- Immutable – transactions can not be canceled

- Pseudonym – no identification is required [19659032] For a more detailed discussion about bitcoins, take a look at our guide depth.

Ethereum

Ethereum adds that extra dimension of flexibility to the cryptocurrency space through intelligent contract solutions. Its decentralized application platform is the reason why we are currently witnessing the boom in the initial supply of coins.

This is also a highly decentralized network with a large number of nodes that protect the network. In fact, according to Ethernodes, the Ethereum blockchain has about three times as many nodes as bitcoins.

For a more detailed discussion of Ethereum, take a look at our in-depth guide.

Blockchain But Not Bitcoin: The Final Score?

While companies like Hedera and IBM are pushing forward with their blockchain ambitions, an important question remains unanswered. How do private blockchains actually differ from existing systems?

Your standard stock database has existed since the years & # 39; 70 and blockchains are nothing but decentralized databases. The innovation lies in the decentralization of the network, in the distribution of power to many network players. Not just for those at the top of the pyramid. Therefore, anyone should be able to validate transactions on a network.

The bitcoin expert Andreas Antonopolous paints this picture quite clearly:

It would seem therefore that most some companies do not really need blockchain because the real blockchains disagree with the objectives of a traditional organization.

Hedera claims to build a public blockchain but Hashgraph technology is not open source and is owned by a company. As a result, the code is not open to public scrutiny and we must once again rely on the team's trust and their promises. Hyperledger Fabric, on the other hand, says he does not even need a cryptocurrency. This raises the question of how their blockchain can actually be verified independently.

You can not separate a blockchain from its underlying currency. The token is essential for decentralization and to drive the value of the network. Separating the technology from the underlying cryptocurrency is similar to the copy-paste of a system we've had for almost 50 years.

The game is young and maybe there is still time for corporate blockchains to test themselves. But for now at least, "blockchain but not bitcoin" simply seems to be a marketing ploy.

Related

[ad_2]Source link