[ad_1]

[ad_1]

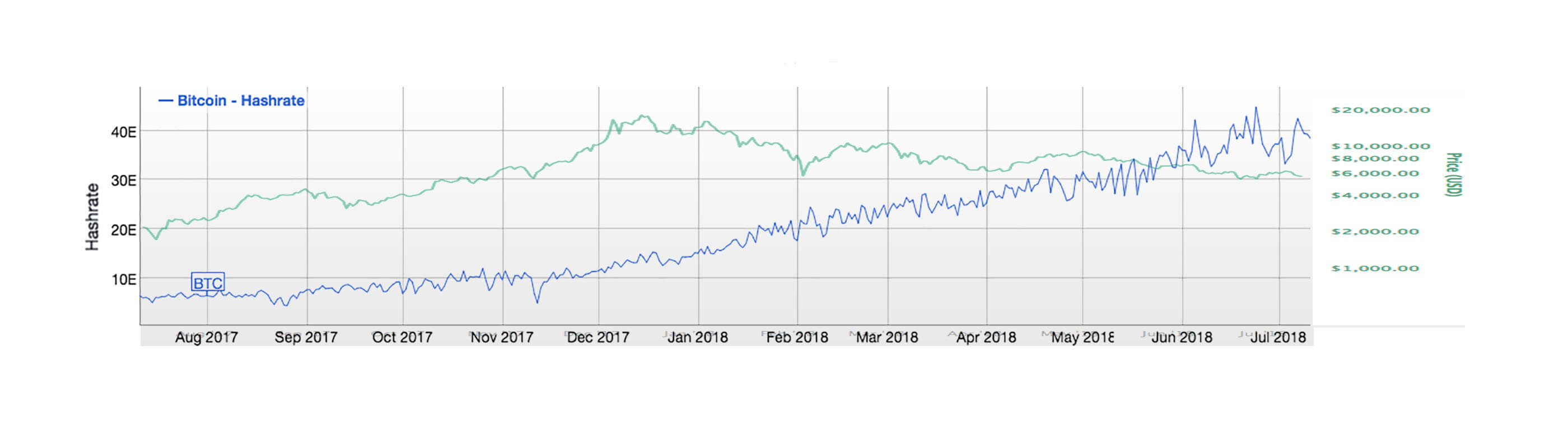

Despite the collapse of Bitcoin 2018 prices, the hashish rate of dominant cryptocurrency continues to rise at an astonishing rate. Although the value of Bitcoin has decreased by 53% since 1 January 2018, the hash rate rose by 155% over the same period of time.

The continued growth of hash power demonstrates a strong and continued belief in Bitcoins by miners around the world and could foreshadow a hidden bullish trend.

Hash Rate Explained

In simple terms, extraction it is the process of performing complex calculations looking for a specific number. In a race to find the number before, extraction The hardware is used to perform as many calculations as possible to protect the block award, currently at 12.5 BTC per block.

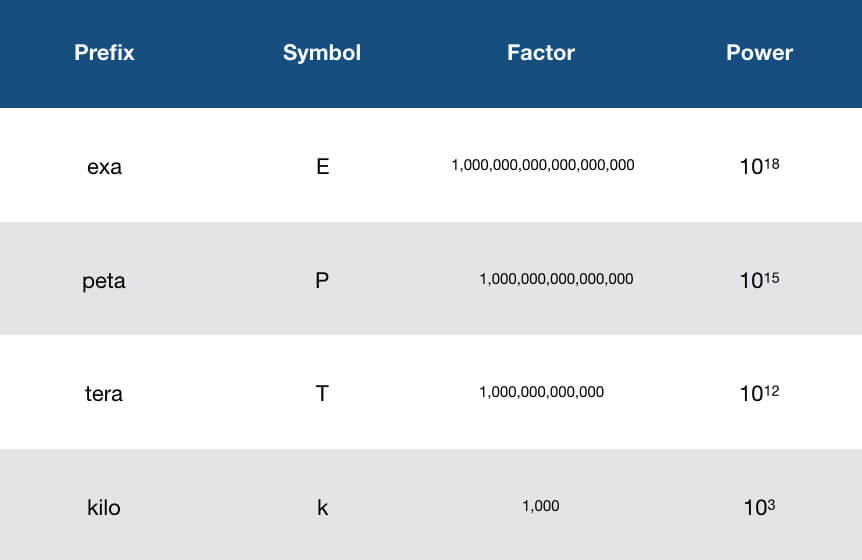

Every calculation attempt to solve the calculation is known as "hash" and "hash rate" is calculated in hashes per second (h / s).

The ASICs (application-specific integrated circuits) have become the only one extraction hardware used to extract Bitcoin due to increased capacity for hash rates and greater energy efficiency. One ASIC has a extraction power of about 12 tera-hashes per second. For comparison, in 2013, the total hash rate of the Bitcoin network on 29 April 2013, it was 79.02 Th / s.

Growing number of miners

The Bitcoin hash rate continues to grow at a rapid pace, indicating an increasing number of Bitcoin miners. So far in 2018, it has grown by 155%, from 15.04 Eh / s to 38.43 Eh / s.

One possible explanation for the increase in the hash rate is the value of Bitcoin. Although Bitcoin has lost a lot of value in 2018, the block award 12.5 Bitcoin is still worth over $ 78,000 today. At the peak of Bitcoin, a single block was worth almost a quarter of a million dollars and miners could see the current market as a way to accumulate more Bitcoin at lower prices.

Another possibility that explains the increase in the hash rate could be the imminent "halvening" of Bitcoin, estimated around May 25, 2020. With the reward destined to decrease from 12.5 BTC per block at 6.25 per block, miners may try to accumulate as much Bitcoin as possible, before the difficulty increases further and the reward decreases. The price of BTC at the time of the last two renovations was $ 660 and $ 12 in 2016 and 2012, respectively.

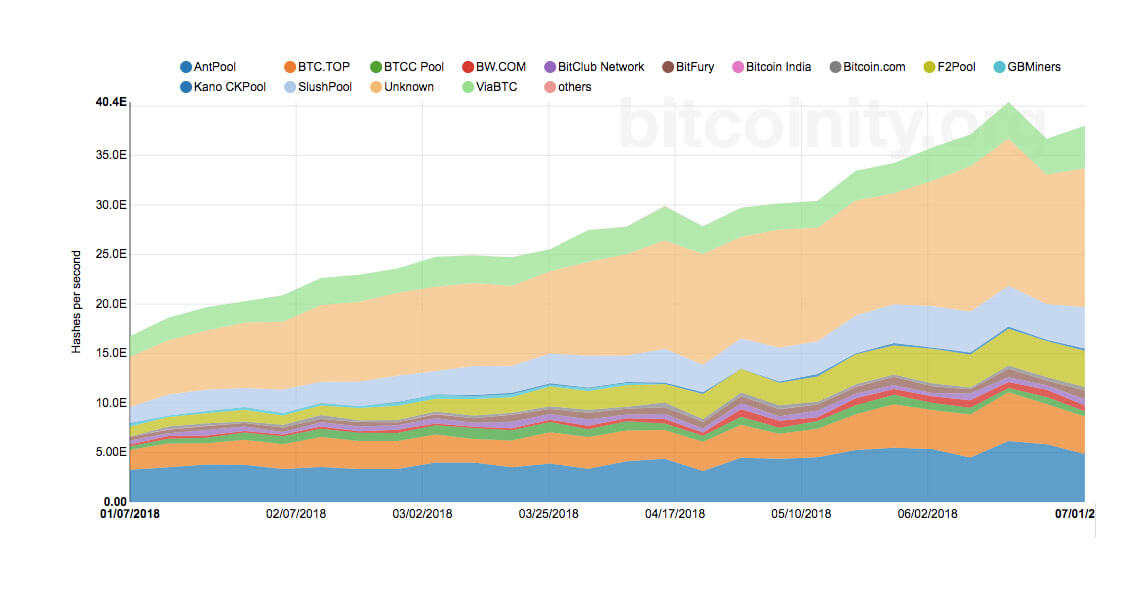

An interesting thing to note in the increase in the hash rate is the contribution of hash power outside the largest in the world extraction pools. This is beneficial for the Bitcoin network as it makes the power of extraction less concentrated.

Overall, it is a positive sign that miners continue to show their support for Bitcoin through the growing growth of the hash rate. Instead of abandoning Bitcoin to extract other cryptocurrencies, they persist and reinforce the Bitcoin network.

It will certainly be interesting to see if the conviction of the miners is ultimately worth it and Bitcoin makes the race that the bulls wait anxiously.

Cover photo by Ivana Cajina on Unsplash

Disclaimer: The opinions of our writers are exclusively their own and do not reflect the opinion of CryptoSlate. None of the information you read on CryptoSlate should be taken as investment advice, nor does CryptoSlate approve any projects that may be mentioned or linked in this article. Buying and exchanging cryptocurrencies should be considered a high-risk activity. Please do your due diligence before taking any action related to the contents of this article. Finally, CryptoSlate assumes no responsibility in case of loss of money in the trade of cryptocurrencies.

Did you like this article? Join us.

Receive blockchain news and crypt insights.

Follow @cryptoslate Join us on Telegram

[ad_2]Source link